Financial literacy is a set of competencies that has been taught more and more in schools and financial institutions across the country in the last twenty years, and is the particular focus of Financial Literacy Week, celebrated during the first week of April.

In honor of Financial Literacy Week, SouthEast Bank is working to remind our customers and communities of the value of cultivating your know-how about budgeting, saving, borrowing, and bank products. It’s never too early–or too late–to “invest” in a deeper understanding of these topics!

Why Is Financial Literacy Important?

Financial literacy is not required to, say, get a car loan or save for retirement. However, being financially literate can often set you up for better success, maximizing opportunities to grow your assets and helping you avoid scams or fraud. If you’re proficient at setting a budget, you’re more likely to not overspend while working toward a savings goal. If you understand credit and interest rates, you’re more likely to get a better student loan or know when it’s the right time for you to buy a house.

Many people struggle with financial management because they were never taught these skills. That’s why financial literacy is emphasized early and often by schools and financial institutions, who help guide young people, families, and, by extension, the community toward a more well-rounded knowledge base and sound decision-making. By equipping people with financial literacy, they are better set up for financial stability and prepared for the choices and challenges they may face in the future.

Four Basics to Know

While a wide array of topics fall under financial literacy, today we’ll focus on four basic skills.

Budgeting

A budget is a great tool to start with when strengthening your money management muscles. In short, a budget is a spending plan for your money that portions your earned income, or any other money you expect to receive, against your expected expenses over a given time period.

An effective budget takes into consideration both fixed and variable expenses. A fixed expense is a standard price per product or service, such as a rent payment or car insurance. Though these may change due to extenuating circumstances, the amount owed doesn’t often change from month to month and should be considered a firm expense in your budget. A variable expense is dependent on other factors, such as a heating bill during a particularly cold month or gas for your car when traveling more on the weekends. These fluctuate, and so may affect your budget in different ways at different times. It’s advisable to look back at your spending patterns over the past year or longer to help you track how much you can anticipate these expenses to vary.

Your budget should also consider what funds you may have remaining after these expenses are paid. How much will you set aside for future needs or goals, and how much will you keep on hand for discretionary purchases like a meal out or a new pair of shoes? A great rule of thumb is the 50/30/20 guideline, which recommends 50% of your income go to “needs,” 30% to “wants,” and 20% to savings. While this may not always be possible, you may utilize the 50/30/20 spending plan as a goal for your personal or family budget.

Saving

Once you’ve established your budget—and kept to it! —you may find saving money a little easier. There are endless reasons why a savings account can come in handy, but the top reason? Emergencies! You never know when an unexpected trip to the hospital or a cracked phone might set you back, and an emergency fund may help you avoid living paycheck to paycheck after disaster strikes.

Another way to incentivize yourself into a viable savings plan is by setting savings goals. If this feels intimidating, start small! Set aside funds to upgrade your television or take a weekend trip with your friends. It’ll feel even better making these purchases from earmarked savings rather than your weekly budget.

Then, as you feel more comfortable, dream bigger with your savings by setting a larger goal amount. Assets like a car or a home often require a sizable down payment, but you can still get there little by little!

A retirement account is itself a form of savings and is a great example of how certain types of accounts or investments can help you earn interest, adding to your bottom line. However, keep in mind that any financial transaction you make with your savings or retirement funds comes with a certain amount of risk!

Borrowing

Sometimes our savings strategies only get us part of the way toward our goals. That is where borrowing comes in. In today’s world, people often use credit or “borrowed” money for all sorts of things, from using a credit card for everyday purchases to purchasing a home. Savvy borrowers are able to use multiple forms of credit simultaneously, and the financially literate consumer knows that a responsible payment history contributes to a healthy credit score.

Regardless of how much wealth you’ve accumulated or how unlikely it is you’ll need a loan or line of credit, a good credit score is important. It’s a significant factor that is considered when making large financial transactions, including lending for large furniture purchases, cars, or a renovation on your home.

In short, borrowing wisely can be a great strategy to get further toward your goals while building your “character” as a consumer.

Banking

Money management can feel like a lot of work! Fortunately, you don’t have to go it alone. Financial institutions like credit unions and banks are there to assist you in financial matters, from depositing your paycheck into a secure account to extending you a loan or line of credit for a major purchase. Since digital banking has become easier to use, account holders can manage their budget, their savings goals, and their borrowed funds right from their favorite device!

Your bank can be your financial partner from your first co-signed account as a teenager to setting up your finances according to your end-of-life plan. When you’re ready to find a bank to work with, consider how close their locations are to you, what kind of products and services they offer, their fees and interest rates, and their trustworthiness based on reviews, reputation, and customer service.

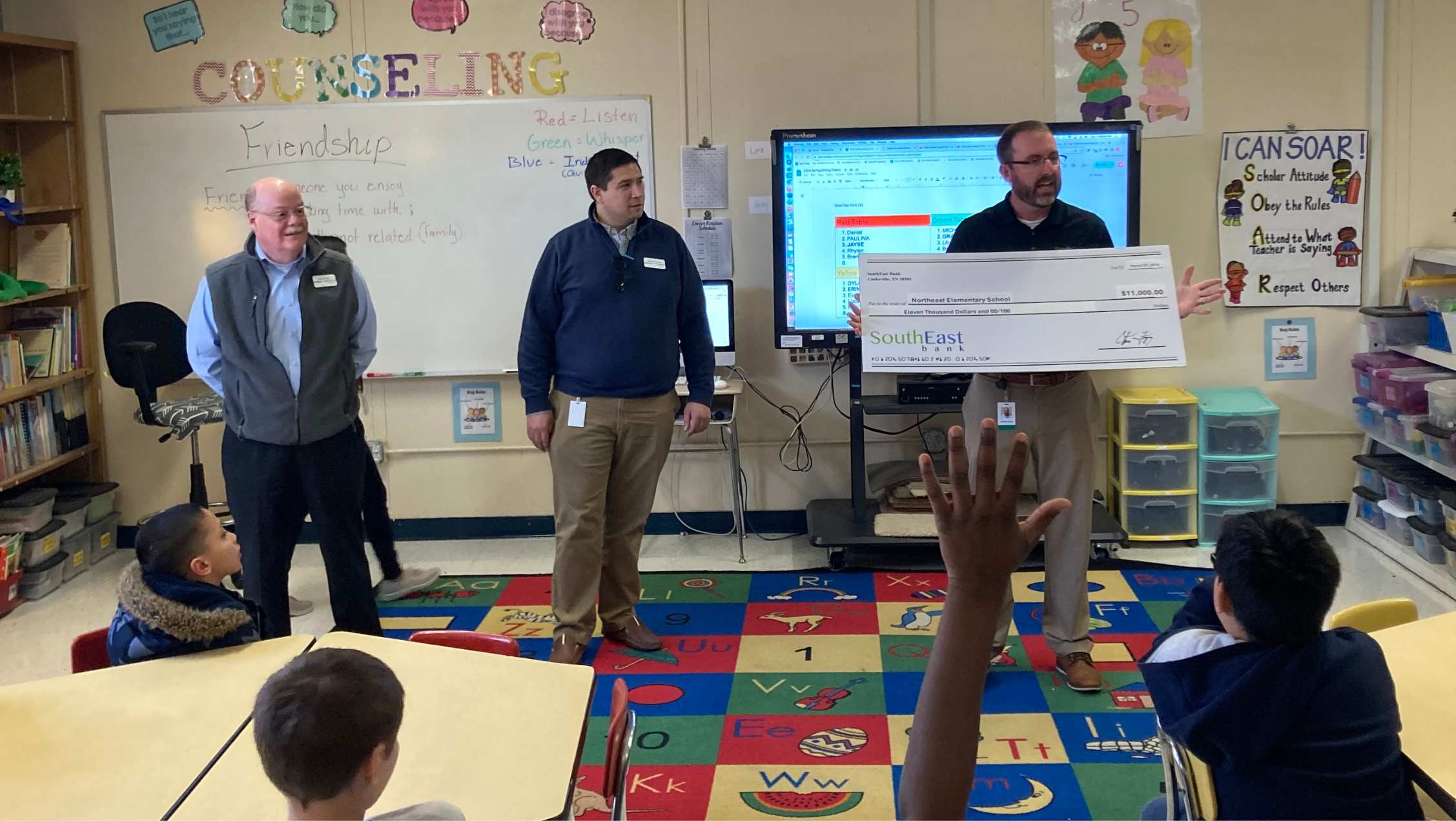

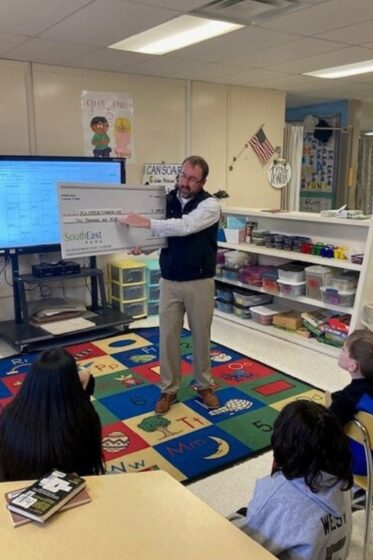

SouthEast Bank Supports Ongoing Financial Literacy

Financial literacy is useful at any age and important to develop at every stage of life as our needs and goals evolve. Make ongoing learning a standard practice for you and your family through books, podcasts, online magazines, or professional or educator advice. Remember, too, that financial literacy may be celebrated this time of year but is important all year round!

To learn more about tools offered by SouthEast Bank or to request financial literacy resources, please contact your local SouthEast Bank branch.

Links to other websites do not imply SouthEast Bank’s sponsorship or approval. SouthEast Bank does not control the content of these sites, services, or applications.

SouthEast Bank is an Equal Housing Lender and Member FDIC.