Recent Articles

What Is a Business Credit Score?

Building a business credit history and a healthy score can help you toward your business goals. Here's what you need to know.

Keep Your Information Safe During Tax Season

Scams are common during the American tax season, and the IRS regularly issues reminders about remaining vigilant.

SouthEast Bank donates $80,000 to local student-focused programs in honor of retiring lenders

SouthEast Bank’s $80,000 donation is part of its comprehensive commitment to reinvest into the communities it serves.

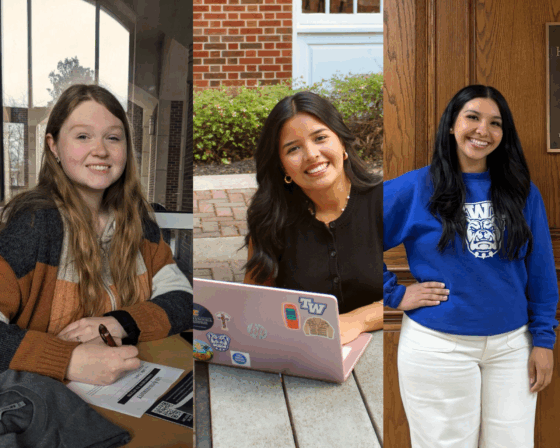

3 SouthEast Bank Scholars Reflect on Scholarships' Impact

Through the SouthEast Bank Scholars program, funds are given directly to colleges and universities to then be distributed to students who qualify for scholarships.

3 Scams to Watch Out For in the Final Days of 2025

Fraudsters are getting creative, using this busy time of year as a way to sneak in with the abundance of...

The End of the Penny and What It Means for Tennessee Families and Businesses

After 232 years, the penny is no longer being produced by the United States Mint.

SouthEast Bank selects Brian Hood as Cleveland City President

Hood's well-rounded perspective and deep understanding of customer and team needs benefit SouthEast Bank in new role.

6 Ways to Refresh Your Finances in Time for 2026

Wow, you tackled a lot this year! As 2026 approaches, be sure to take stock of all of the financial wins you...

Good to Know: Daniel Elrod, Cleveland Branch Manager

Next time you visit our Cleveland location, be sure to local native and returning SouthEast Bank team member, Daniel Elrod.