As the rush of the new year begins to wear off, the stark reality of tax season looms large on the horizon. The IRS officially set January 23rd as the first date that filers can begin to submit their 2023 tax returns, and the good news is that many Americans can expect a tax refund based on inflation-adjusted tax brackets.

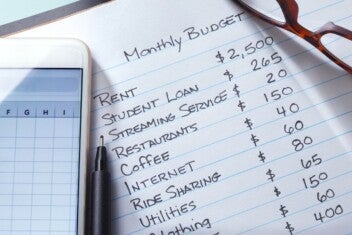

Getting a lump sum of this size can lead people to splurge on wishlist items–a new television, an upgraded vacation, or a downpayment on another vehicle. Once those are bought, however, what’s left?

Using your tax refund thoughtfully can ensure that you feel the positive effects on your finances throughout the year. We encourage you to learn more about how local tax-related policies affect you and your family and to consider the following strategies to stretch your refund further in 2024.

Tax Considerations for Tennessee Filers

One 2023 tax season update that Tennessee residents should be aware of is our state’s participation in the 2024 Direct File pilot, a new service that will allow many taxpayers to electronically file their federal tax return directly with the IRS. Though eligibility is limited, and state returns will still be filed separately as needed, those who have “relatively simple [federal] returns” can file for free by choosing Direct File.

Residents of Davidson, Dickson, Montgomery and Sumner counties are also eligible for an extended tax deadline in light of recent tornadoes that have affected middle Tennessee communities. Families and businesses located in these areas can seek filing or payment relief based on qualifications that are continually updated on the IRS website.

Don’t hesitate to seek more information about local and regional tax benefits and, as always, consult a tax professional in case of questions about how these and other new policies may pertain to you.

Make the Most of Your Tax Refund with These Strategies

1) Boost Your Savings

Take advantage of the option to split your tax refund direct deposit into multiple accounts so that you can automatically add funds to your savings or emergency reserve. By eliminating an extra step, you can more easily resist the temptation of short-term wants by keeping a portion out of sight–and out of mind! Later on, you’ll appreciate the favor you did yourself when seeing the interest you may have earned. Plus, if you find yourself in a pinch, that money will still be there to help you get by.

2) Pay Down Debt

If you have high-interest debt, like large credit card balances, student loans, or medical bills, the charges you rack up over time will far outweigh what you originally spent. By using your tax refund to make a dent in your balance, you can reduce the interest that accrues to pay off your debt faster. Often there’s no penalty for making a lump sum payment or payoff, but be sure to check your credit agreements.

3) Start a College Fund

Your kids or grandkids will thank you when they learn you’ve put money toward a college fund in their name. There is always the 529 College Savings Plan, but there are a number of fantastic Tennessee-based programs to look into as well. This is a longer-term strategy you can put in place to help your loved ones stave off student debt, but there are also tax deductions for utilizing these programs that you can opt into along the way.

4) Make Home Efficiencies

If you own your home, you know firsthand how all the little things add up. Spend some of your tax refund to take care of those items that are adding to your monthly costs, like old windows and outdated or faulty appliances. It also might be a good time to take on bigger ticket items, like roof repair or the HVAC unit. Investing in energy efficient updates may alleviate your everyday bills and improve the long-term value of your home.

5) Make That Healthcare Appointment

If you’re reluctant to use your insurance because of high deductibles, having extra money on hand might incentivize you to get that health screening or teeth cleaning you’ve been putting off. Taking care of your physical health is always a good investment, and regular checkups can prevent scarier or costlier care down the road.

6) Give Your Car Some TLC

Car maintenance is often the last thing we want to take on, especially with so many other pressing wants and needs. However, with proper care and maintenance to your car, you are likely to prevent more costly repairs, and even pay yourself back with better fuel efficiency! Take advantage of your tax refund to take your car in for scheduled maintenance, and consider replacing your tires while you’re at it.

7) Invest in Your Career

If you’re looking to take the next step in your profession, now might be the perfect time to take a course in a new skill or apply for special certification. Many employers will contribute in part to your tuition or license costs, and you can utilize your tax refund for the remainder. As an added bonus, you may be eligible for a Lifetime Learning Credit on next year’s taxes.

8) Open a Brokerage Account

If you’ve maxed out your retirement accounts or want to invest for other goals, open a taxable investment account with a brokerage firm. They can advise you about investing your tax refund in stocks, bonds, mutual funds, or exchange-traded funds. Giving your money a chance to grow over a given time period will certainly earn you greater value from your refund.

Enjoy More of What Matters with Your Tax Refund

They may not have 4K resolution or all-wheel drive, but these strategies for using your tax refund are far from boring. In fact, you’ll find that these may feel like splurges, leading to a potential longer-term return on your satisfaction and financial wellbeing.

Be prepared to file your 2023 taxes with the help of a tax professional. Then make a plan for how you’ll use your tax refund to take care of yourself and your loved ones, both now and for all the good times to come.

Nothing contained in this blog should be construed as legal, tax, or financial advice. An attorney, tax advisor, or financial advisor should be consulted for advice on specific issues.